File Your Taxes From Any Mobile Device

File Your Taxes From Any Mobile Device

Who Are We?

F & S Tax Service is a leading organization on tax and other related matters. We offer clients a very affordable and professional tax filling system. At F & S Tax service, we aim to provide an efficient, transparent, and error-free computation for all taxpayers which include: Lawyers, Truck Drivers, self-employed workers, college students, and office workers. Our Virtual Tax solutions makes it easy to file from anywhere in all 50 states.

Who Are We?

F & S Tax Service is a leading organization on tax and other related matters. We offer clients a very affordable and professional tax filling system. At F & S Tax service, we aim to provide an efficient, transparent, and error-free computation for all taxpayers which include: Lawyers, Truck Drivers, self-employed workers, college students, and office workers. Our Virtual Tax solutions makes it easy to file from anywhere in all 50 states.

STEPS TO USING OUR MOBILE TAX PREP SERVICES

Book Your Appointment

Go to the calendar below and book your virtual appointment

Receive Our Mobile App Link

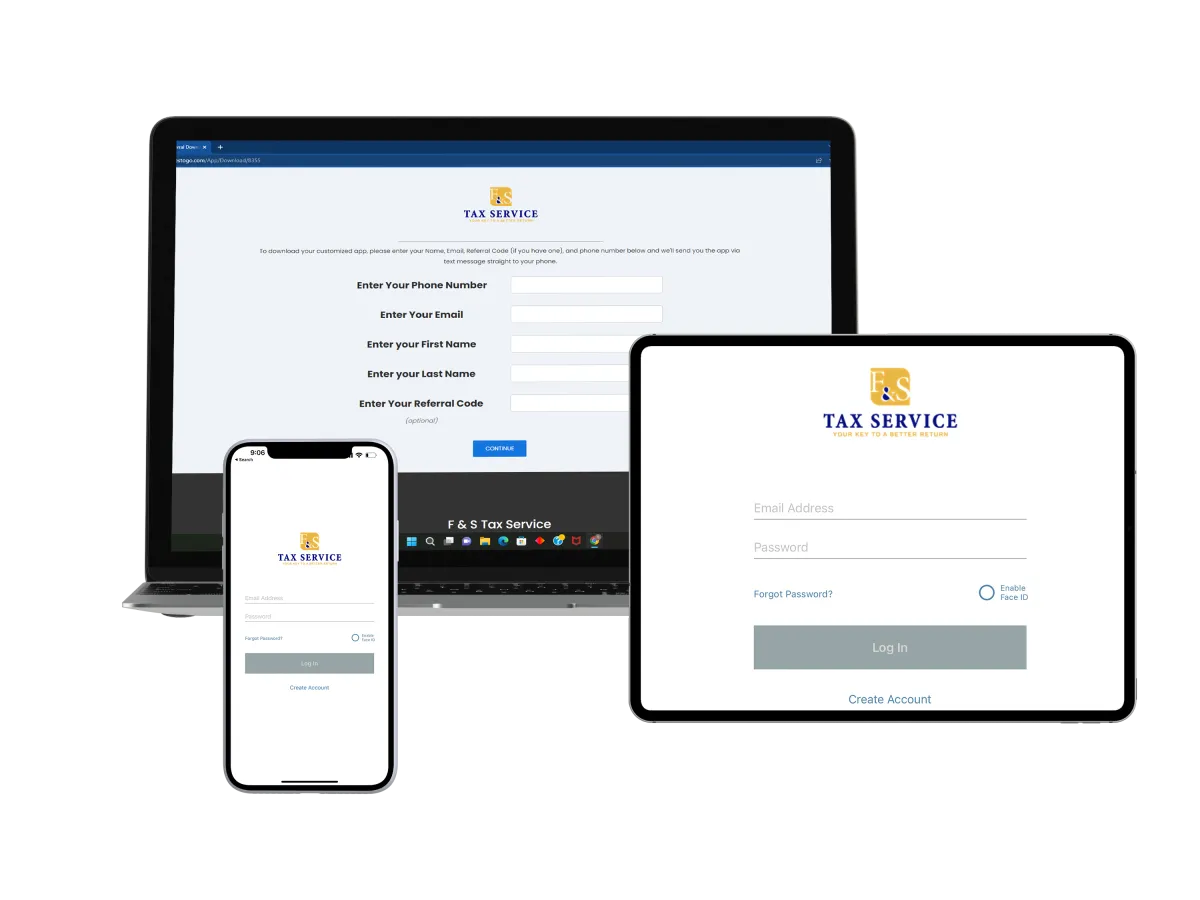

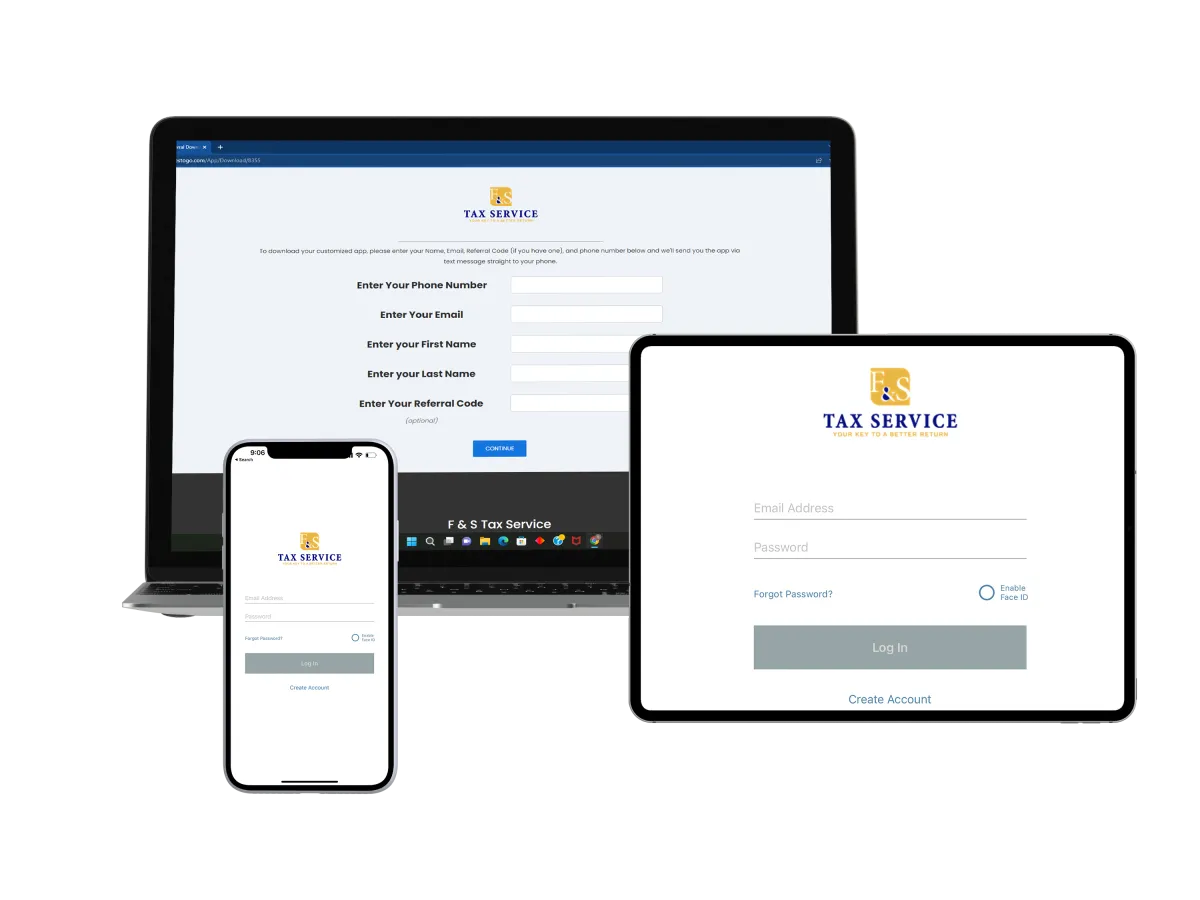

Upon booking your appointment you will receive our mobile app link via text message

Update Your Personal Info

Follow the mobile app link, create your login, add your personal information within the app, and upload all documents

Wait On Your Preparer To Contact You

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

STEPS TO USING OUR MOBILE TAX PREP SERVICES

Book Your Appointment

Go to the calendar below and book your virtual appointment

Receive Our Mobile App Link

Upon booking your appointment you will receive our mobile app link via text message

Update Your Personal Info

Follow the mobile app link, create your login, add your personal information within the app, and upload all documents

Wait On Your Preparer To Contact You

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

F & S Tax Service is a global firm that helps individuals, corporate bodies, professionals, and private sectors to file their returns accurately. Our tax filing service has given us a top-notch due to the tax experts we possess in this firm. You only need to present in your returns and leave the rest to us; we are committed to being transparent, affordable and accountable for all the taxpayers.

F & S Tax Service is a global firm that helps individuals, corporate bodies, professionals, and private sectors to file their returns accurately. Our tax filing service has given us a top-notch due to the tax experts we possess in this firm. You only need to present in your returns and leave the rest to us; we are committed to being transparent, affordable and accountable for all the taxpayers.

TAX PROS WHO BELIEVE IN GETTING YOU THE MAX CASH ADVANCES $500-$7,000 STARTING JANUARY 3RD

TAX PROS WHO BELIEVE IN GETTING YOU THE MAX CASH ADVANCES $500-$7,000 STARTING JANUARY 3RD

BOOK YOUR APPOINTMENT

Upon booking your appointment you will receive a text message with the link to F & S Tax Service Mobile App. Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

BOOK YOUR APPOINTMENT

Upon booking your appointment you will receive a text message with the link to F & S Tax Service Mobile App. Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

About Ruby Gonzalez

All of my clients get top-notch customer service and a full range of tax preparation services. I will utilize strategies that minimize your tax liabilities and MAXIMIZE your tax refund. Book an appointment and I'll make sure you have a great experience, any questions answered, and we'll start the Tax Return process once you're comfortable.

BOOK YOUR APPOINTMENT

All of my clients get top-notch customer service and a full range of tax preparation services. I will utilize strategies that minimize your tax liabilities and MAXIMIZE your tax refund. Book an appointment and I'll make sure you have a great experience, any questions answered, and we'll start the Tax Return process once you're comfortable.

WHY CHOOSE US

1

EASY COMPUTATION AND FILING SYSTEM

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

2

TAX COMPLIANCE & ADVISORY

F & S Tax Service has continuously long gone over and beyond primary tax compliance offerings for each small group of people. We provide innovative, treasured transaction structuring and tax making plans designed to acquire your commercial enterprise and individual goals in the most greenway

3

VIRTUAL TAX PREPARATION

F & S offers tax preparation virtually to all of our clients. File from the comfort of your home and submit all documentation via email, fax, Or simply request a quote/submit all documents on our secured website. We provide our services to Clients in all 50 states.

4

F & S MOBILE TAX PREP APP

Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

WHY USE US

1

EASY COMPUTATION AND FILING SYSTEM

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

2

TAX COMPLIANCE & ADVISORY

F & S Tax Service has continuously long gone over and beyond primary tax compliance offerings for each small group of people. We provide innovative, treasured transaction structuring and tax making plans designed to acquire your commercial enterprise and individual goals in the most greenway

3

VIRTUAL TAX PREPARATION

F & S offers tax preparation virtually to all of our clients. File from the comfort of your home and submit all documentation via email, fax, Or simply request a quote/submit all documents on our secured website. We provide our services to Clients in all 50 states.

4

F & S MOBILE TAX PREP APP

Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

FAQ'S

What documents do I need to do my taxes?

Below is a list of documents that you will need in order to get your taxes prepared.

PERSONAL INFORMATION FOR EACH FAMILY MEMBER:Name, Date of Birth, Social Security Card /ITIN/ATIN, Last Year’s Tax, Return, Valid Driver’s License, W2, Business Expenses (If Applicable)

How can I check the status of my refund?

The 'Where’s My Refund' tool on the IRS website provides the most up-to-date information regarding the status of your refund. This tool is updated every 24 hours.

What documents should I receive from my employer?

The forms to prove employment may vary depending on individual situations. For most, an employer will provide a W-2 form. The self-employed (i.e. independent contractors, product sales representatives such as Mary Kay, etc.) should receive a 1099-NEC from the company.

When is the earliest that I can file my taxes?

Self-Employed individuals could file as early as January 3rd. W2 employees would have to wait until they receive their W-2.

FAQ'S

What documents do I need to do my taxes?

Below is a list of documents that you will need in order to get your taxes prepared.

PERSONAL INFORMATION FOR EACH FAMILY MEMBER:Name, Date of Birth, Social Security Card /ITIN/ATIN, Last Year’s Tax, Return, Valid Driver’s License, W2, Business Expenses (If Applicable)

How can I check the status of my refund?

The 'Where’s My Refund' tool on the IRS website provides the most up-to-date information regarding the status of your refund. This tool is updated every 24 hours.

What documents should I receive from my employer?

The forms to prove employment may vary depending on individual situations. For most, an employer will provide a W-2 form. The self-employed (i.e. independent contractors, product sales representatives such as Mary Kay, etc.) should receive a 1099-NEC from the company.

When is the earliest that I can file my taxes?

Self-Employed individuals could file as early as January 3rd. W2 employees would have to wait until they receive their W-2.